- 07/10/2024

- MyFinanceGyan

- 201 Views

- 5 Likes

- Investment

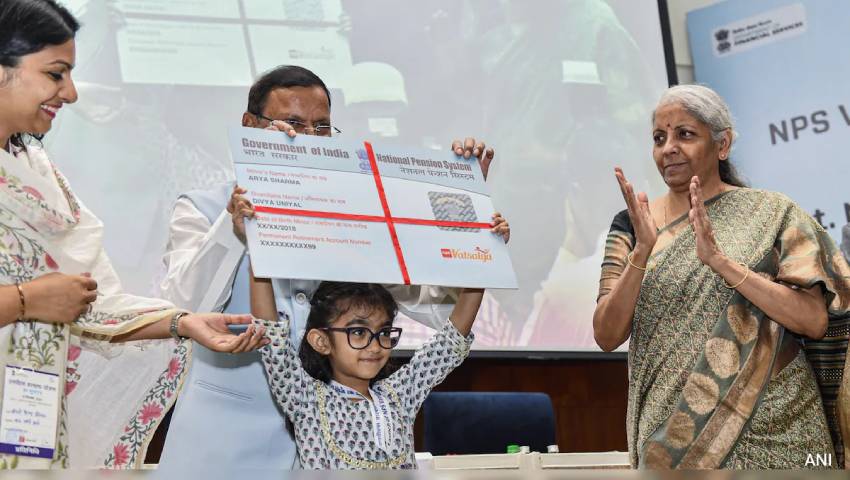

NPS Vatsalya

NPS-Vatsalya is a financial investment that parents/guardians can make on behalf of their minor children with minimum contribution of ₹1000 per year and no limit on maximum contribution, serving as a meaningful way to provide them with financial support until they start earning and investing on their own.

Eligibility:

All minor citizens (age till 18 years) are eligible.

Operation:

- Account opened in the name of minor and operated by Guardian.

- Minor to be sole beneficiary.

Where to open account?

- The NPS for Minor account can be opened through Point of Presence (POPs) registered with PFRDA either online or physical mode, which include major banks, India Post, Pension Fund etc. (List of PoPs is available on PFRDA website – www.pfrda.org.in).

- The online platform (eNPS) of NPS Trust

Documents required:

Following documents are required for applying under NPS-Vatsalya

- Date of Birth proof of the Minor (Birth certificate, School leaving certificate/ Matriculation Certificate, PAN and Passport)

- KYC of the Guardian shall be carried out by submitting Proof of Identity and Address (Aadhaar, Driving License, Passport, Voter ID card, NREGA Job Card and National Population Register)

- NRE / NRO Bank Account (solo or joint) of the minor in case guardian is NRI.

Issuance of PRAN:

PRAN will be issued in the name of minor.

Pension Fund Selection:

Guardian can choose any one of the Pension Fund registered with PFRDA.

Investment Choice:

- Default Choice: Moderate Life Cycle Fund -LC-50(50% equity)

- Auto Choice: Guardian can choose Lifecycle Fund – Aggressive -LC-75(75% equity), Moderate LC-50 (50% equity) or Conservative-LC-25 (25% equity) as per his/her risk appetite.

- Active Choice: Guardian actively decides allocation of funds across Equity (upto 75%), Corporate Debt (upto 100%), Government Securities (upto 100%) and Alternate Asset (5%).

Exit / Withdrawal and Death before 18 Years of age:

- Partial withdrawal upto 25% of contribution on declaration basis after lock-in-period of 3 years for education, specified illness and disability for maximum three times till subscribers attains 18 years of age.

- Exit upon attainment of 18 years subject to:

- Accumulated Corpus is equal to or greater than 2.5 lakh – at least 80% of balance to be utilized for purchase of annuity and remaining balance in lump sum.

- Accumulated Corpus is less than 2.5 lakh – Option to withdraw entire balance as lump sum.

- Death of the minor: entire accumulated Corpus returned to the guardian.

- Death of the guardian: another guardian to be registered through fresh KYC. In case of death of both parents, the legally appointed guardian can continue the account with or without making contributions to the account, and upon attainment of 18 years of age, the subscriber has an option to continue or exit from the scheme.

Upon attainment of age of 18 years:

- Seamless shift to NPS Tier – I (All Citizen)

- Fresh KYC of the minor within three months from date of attainting 18 years.

- Upon transitioning, the features, benefits, and exit norms of the NPS-Tier I for All Citizen Model will apply

Please note,

The views in the article/blog are personal and that of the author. The idea is to create awareness and for educational purpose and not intended to provide any product recommendations.